Space Tech

PNT Industry Has Come to a Turning Point

A plain-English tour of the GNSS/PNT market in 2024—what’s growing, who’s winning, why resilience matters, and where the puck is headed.

If you use a phone, drive a car, fly in a plane, grow food, time a stock trade, or track a parcel… you’re using PNT (Positioning, Navigation, and Timing). 2024 feels like a hinge year for this industry: demand curves are still up-and-to-the-right, but resilience is now the storyline. Below is my digest of the EUSPA EO & GNSS Market Report 2024—sprinkled with a few timely takeaways from NAVAC—so you can see where value is created, who the main players are, and why “assured PNT” is the next competitive moat.

Headline numbers

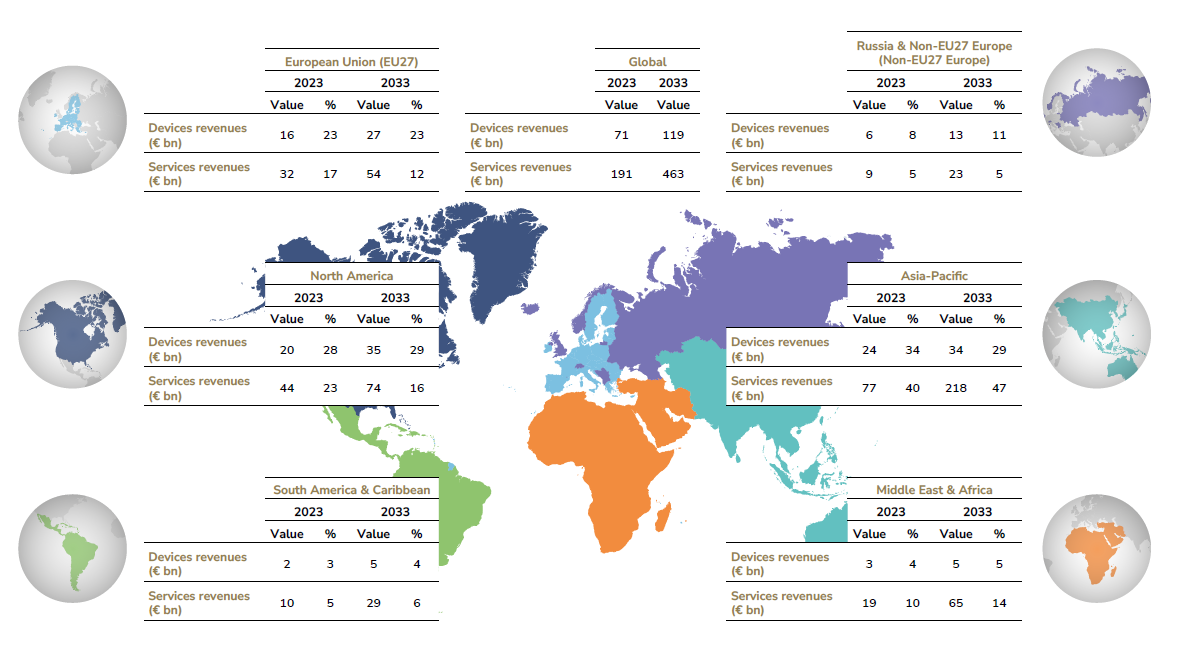

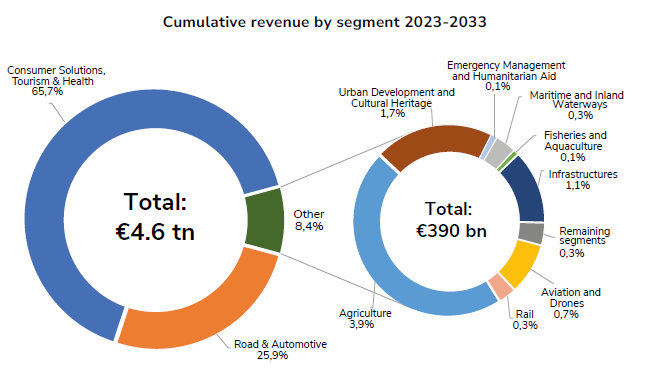

- Revenues keep climbing. EUSPA projects combined EO+GNSS downstream revenues growing from €260B in 2023 to ~€590B by 2033; cumulative GNSS downstream revenues alone are expected to exceed €4.5T over 2023–2033.

- Devices everywhere. Annual GNSS device shipments rise from ~1.6B (2023) to >2.2B (2033). Installed base grows from ~5.6B to ~9.0B over the same period. Consumer devices still dominate (~90% of installed base today) but gradually give ground as pro segments expand.

- Apps are the sleeper giant. GNSS-enabled app revenues (navigation, tracking, fitness, social) jump from ~€100B (2023) to ~€300B (2033)—with navigation/tracking swelling from ~€80B to ~€230B.

Which markets are actually growing?

EUSPA tracks 15 segments. Here are the standouts:

- Road & Automotive: The quiet engine of growth. As in-vehicle systems (IVS), telematics, eCall, road-user charging, and connected/autonomous functions become standard, this segment’s slice of the installed base rises from >10% (2023) to >15% (2033).

- Agriculture: From autosteer to variable-rate inputs and fleet monitoring, ag becomes the #2 GNSS segment by 2033 (~20% share)—up from <7% in 2023—as precision tools move from “nice to have” to default.

- Aviation & Drones: Steady climb in units (from ~44M to ~50M by 2033) with certification/integrity requirements keeping margins durable.

- Maritime: Large and essential (especially timing + e-navigation), but its global share inches down as other segments outpace it in growth.

- EO-adjacent tailwinds: On the Earth Observation side, Insurance & Finance grows from ~€340M (2023) to ~€900M (2033) in EO data/services—relevant because GNSS + EO bundles underpin risk and claims analytics.

Quick table — momentum at a glance

| Segment | 2023 Share/Units (approx.) | 2033 Outlook (approx.) | Why it’s growing |

|---|---|---|---|

| Road & Automotive | >10% installed base | >15% installed base | IVS, eCall, C-ITS, ADAS, usage-based services |

| Agriculture | <7% installed base | ~20% installed base | Autosteer, guidance, VRT, fleet ops |

| Aviation & Drones | ~44M units | ~50M units | Certification + integrity demand |

| Maritime | Stable | Slight share decline | Other segments growing faster |

| Apps (all) | ~€100B revenue | ~€300B revenue | Nav/tracking eats the stack |

Methodology note: For multi-function devices (e.g., smartphones), EUSPA counts only the GNSS component value, not the full device price. Region charts show demand (where devices/services are used); market-share pages reflect supply (vendor HQ). Keep that lens when comparing “who buys” vs “who sells.”

The value chain (GNSS/PNT)

- Constellations & augmentation: GPS, Galileo, BeiDou, QZSS, SBAS/EGNOS.

- Chips & receivers: RF front-ends, baseband, timing receivers; increasingly multi-frequency and authenticated.

- Modules & OEMs: Boards, antennas, timing modules, integrated units.

- System integrators: Auto Tier-1s, UAV platforms, ag machinery, maritime bridge, rail signaling.

- Value-added services & apps: PPP/RTK, integrity/monitoring, mapping, tracking, analytics, GNSS-enabled mobile apps.

EU industry share (ballpark): ~20% in components/receivers, >25% in system integration, and ~20% in value-added services—higher in Maritime (~45%) and Finance (~70%), lower in consumer solutions (~5%).

Who are the main players?

- Upstream: Public operators of constellations/augmentation (US GPS, EU Galileo/EGNOS, China BeiDou, Japan QZSS, etc.).

- Chips/receivers: Concentrated across US/EU/Asia; Europe’s slice ~20%.

- Integrators & platforms: Auto Tier-1s, tractor/implement OEMs, maritime bridge suppliers, survey/RTK network operators, drone stack providers. Europe holds >25% in system integration.

- Apps/services: Navigation, fleet/asset tracking, insurance telematics, safety/eCall, fintech timing, and the long tail of GNSS-enabled mobile apps (fastest-growing revenue pool).

Tech trends reshaping PNT

- Multi-frequency + authentication (e.g., Galileo OSNMA) shift from nice-to-have to table stakes to counter spoofing and improve integrity.

- Sector-specific receivers (rail-grade DFMC, safety-related) move from pilots to deployment, unlocking new safety-critical uses.

- LEO-PNT complements MEO GNSS with geometry, power, and diversity; not a replacement, but a serious resilience layer.

- On-device processing (tight coupling with INS/vision, advanced multipath mitigation) and eventual quantum timing/sensing improve robustness.

Why this matters (beyond maps on your phone)

GNSS underpins critical infrastructure—especially timing for finance, energy, and telecom. When GNSS hiccups, costs rack up quickly; independent studies cited by NAVAC put annual benefits in the hundreds of billions (US) and tens of billions (UK/EU), with per-day outage losses reaching up to ~€£$1B in worst cases. The bottom line: it’s not just navigation; it’s the invisible clock for the modern economy.

The main threat: interference, jamming, spoofing

This is no longer hypothetical. We’ve seen airport-scale disruptions and regional spoofing affecting commercial flights. Consensus view:

- GNSS is vital—and fragile.

- Timing is the riskiest single point of failure.

What to do about it

- Architect for diversity: Pair multi-frequency/authenticated GNSS + inertial + vision/SLAM + terrestrial timing (e.g., eLORAN where available) + network positioning (5G/6G when it’s truly available).

- Invest in integrity: RAIM/ARAIM, receiver autonomy, anomaly detection, and anti-jam/spoof capabilities should be procurement requirements, not optional extras.

- Policy + industry alignment: Critical-infra timing needs redundant PNT by design; demand is shifting to complementary (not single-source) PNT.

Why I’m calling this a turning point

The 2010s were the decade of ubiquity (GNSS in everything). The 2020s are the decade of assurance (GNSS that holds up when things get weird). The money is still flowing—devices, services, apps—but the premium shifts to trustworthy PNT: authenticated signals, multi-layer architectures, and vertical-specific receivers that can prove integrity. That’s where winners will differentiate.

TL;DR for builders and buyers

- Budget for multi-frequency + authentication now.

- Treat automotive and agriculture as the biggest expanding surface for GNSS hardware revenue this decade.

- Expect apps (navigation/tracking) to keep eating the value stack.

- Plan for resilience: interference happens; timing is the soft spot. Build fallback.

Sources

- EUSPA — EO & GNSS Market Report, Issue 2 (2024). (Market size, segment growth, methodology, EU industry share.)

- NAVAC — White Paper (May 2024). (Resilience, incidents, and the case for alternative/complementary PNT; LEO-PNT outlook.)

My Amazon Picks

As an Amazon Associate I earn from qualifying purchases.

Shark AI Ultra Robot Vacuum

Matrix Clean charts every room, grabs the mess, then offloads dust into a 60-day HEPA self-empty base.

- Hands-free scheduling and voice/app control with precise home mapping.

- Anti-allergen filtration traps pet dander while the self-empty dock handles the bin.

Join the discussion

Thoughts, critiques, and curiosities are all welcome.

Comments are currently disabled. Set the public Giscus environment variables to enable discussions.